-

13years on the global market

-

14portfolio companies across North America, CIS countries, and the Middle East

-

6industries

Market Review

US market context

For the second time this year, S&P hits a new high reaching 2966 points. Since the beginning of the year, there has been an upward trend on the market. Whether the trend remains or not strongly depends on

- FRS’s changes in the interest rate,

- the results of the trade talks between the USA and China,

- military situation in the Middle East, namely in Iran

Considering the reaction of the Federal Reserve and the outcome of the G20 negotiations between the USA and China, weexpect a short-term S&P growth with a fresh all-time high.

It is also worth mentioning that 10-year and 2-year US Treasury bond yield spread fallingin time is directly or indirectly indicativeof an approaching global crisis. The difference still remains positive.

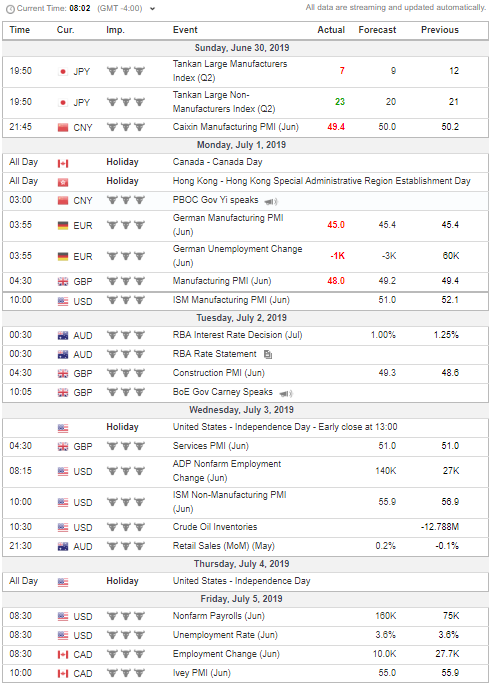

News of the week to come

The curious case of Tesla stocks this week

I cannot help mentioning one of the most interesting events in the American business, which is Tesla Q2 car delivery announcement. Staying on the level of 50-day's moving average and much lower than 200-day's moving average the stock is standing in the wings, maybe waiting to skyrocket after the company’s sale news breaks. Elon Musk reassures his investors there is need to worry and the Q2 figures will be a welcome surprise. Well, we are close now. Let's wait for Wednesday.